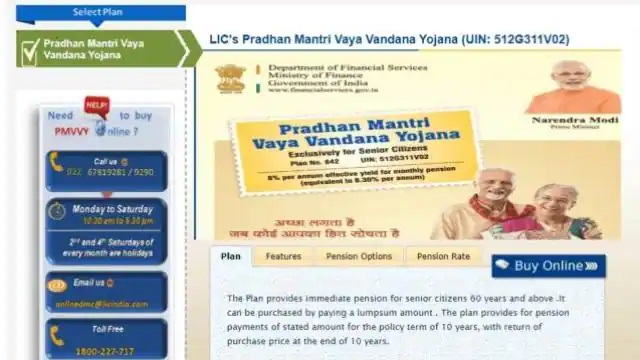

There are a large number of people in India who do not get any pension after retiring. In such a situation, keeping in mind the people, the Government of India started the Vaya Vandan Yojana in 2017. Last year, its deadline was extended to 2023. By March 31 this year, if you buy this pension scheme then you will get payment at 7.40 percent interest rate. The biggest feature of this scheme is that you can take pension together on month, quarter, half year and year completion. Let us know some important things related to Vaya Vandana Scheme: –

A maximum investment of Rs 15 lakh can be made in this scheme. If the age of both husband and wife is more than 60 years, then in such a situation both people can take advantage of this scheme. Investments can be made in this scheme for a maximum period of ten years. Pensioners will also get the facility of loan to complete 3 years time.

| Pension option | Rate of interest |

| Monthly | 7.40% |

| Quarter | 7.45% |

| Half yearly | 7.52% |

| Yearly | 7.60% |

Who will get money on the death of pensioners

Pension will be given along with the deposited amount if the pensioner is alive for a policy term of 10 years. If the pensioner dies, the deposit amount will be returned to the nominee on death of the pensioner within 10 years of the policy term. The deposited amount will be refunded if the pensioner commits suicide

How to invest

You have to go to the official website of LIC for this scheme. Or you can also take advantage of this through an agent. On buying this insurance offline, you will have 15 days to return it, while on buying online, there will be 1 month time.