But there’s no clarity on how EPFO will source money in certain scenarios

There has been a lot of confusion after the SC and Kerala High Court orders on Employees’ Provident Fund. In a two-part series we try to clear the confusion.

Let’s take a look at this pointwise:

1 The Employees’ Pension Scheme (EPS) was launched in 1995, in order to give pension to employees who worked in the private sector. As we know, the employer deducts 12% from the employee’s basic plus dearness allowance (DA), towards a contribution to the Employees’ Provident Fund (EPF). The employer also matches this contribution of 12% from its end. Of the 12% that the employer contributes to the EPF, 8.33% goes towards the EPS.

This is subject to a maximum basic plus DA of Rs 15,000 per month. What does this mean? Let’s say the basic plus DA of an individual is Rs 50,000 per month. The contribution to EPS will be limited to 8.33% of Rs 15,000, which works out to Rs 1,249.50 per month. The remaining amount of Rs 4,750.50 (12% of Rs 50,000 – 8.33% of Rs 15,000) will go into the EPF.

The corpus that is accumulated by contributing to the EPS every month is used to pay a pension after retirement.

2 The formula for the pension every month is (number of completed years of services+2 years) multiplied by (Rs 15,000 or the average pensionable salary if it is less than Rs 15,000) divided by 70. A bonus of two years is given only to individuals who have completed 20 years of service. Also, the maximum number of years of service that is considered for a pension is 35 years, even if an individual has worked for more than 35 years.

The average pensionable salary in this case, is the average of the basic plus DA drawn for the last 60 months. Let’s consider an individual who has worked for 36 years and whose average basic plus DA for the 60 months before retirement, works out to Rs 40,000 per month.

What will be his pension in this case? The number of completed years that will be considered for calculation of pension will be 35 years. The pensionable salary which will be considered will be Rs 15,000, the maximum allowed, even though the average of basic plus DA for the last 60 months works out to Rs 40,000. The pension in this case will work out to Rs 7,500 per month (Rs 15,000 x 35/70).

3 This is how things stood. The Kerala High Court gave a judgement in October 2018, which the EPFO challenged in the Supreme Court and the Supreme Court dismissed it. How does this change things on the EPS front?

The Kerala High Court basically said that the pension should be calculated on the actual basic plus DA of the last 12 months before retirement. This basically means two things. The upper limit of Rs 15,000 as far as the pensionable salary goes is no longer valid. Also, the average pensionable salary will now be calculated on the basic plus DA for the last 12 months before retirement and not the last 60 months, as was the case earlier.

How does this change things? Let’s consider the case of the same individual we did earlier. Let’s say his basic plus DA in the last 12 months is Rs 50,000. Now the pension that will have to be paid will be Rs 25,000 per month (Rs 50,000 x 35/70), which will be substantially more than the Rs 7,500 per month currently.

What this judgement has done is that it has removed the cap on pension of Rs 7,500 per month, that had prevailed. From now on, the higher the basic plus DA in the period of 12 months before retirement, the higher the pension after retirement.

4 People who are on the verge of retiring will see an increase in their pensions. The question is where is EPFO going to get this money from? A simple explanation lies in the fact that money will be moved from the EPF account to the EPS account, in order to ensure that EPFO has enough money to keep paying out pensions in the years to come. Hence, the EPF that the employee will get on retirement will come down.

5) What about people who have retired? EPFO will have to pay arrears to those who have retired or their spouses (in case of death) or their nominees (in case of death of both employee and spouse). This is going to be the trickiest part. First and foremost, where is the money going to come from? In case of current employees on the verge of retirement, the EPFO has the option of moving money from their EPF account to the EPS account. In case of retired employees, how is this going to be executed? This remains the joker in the pack.

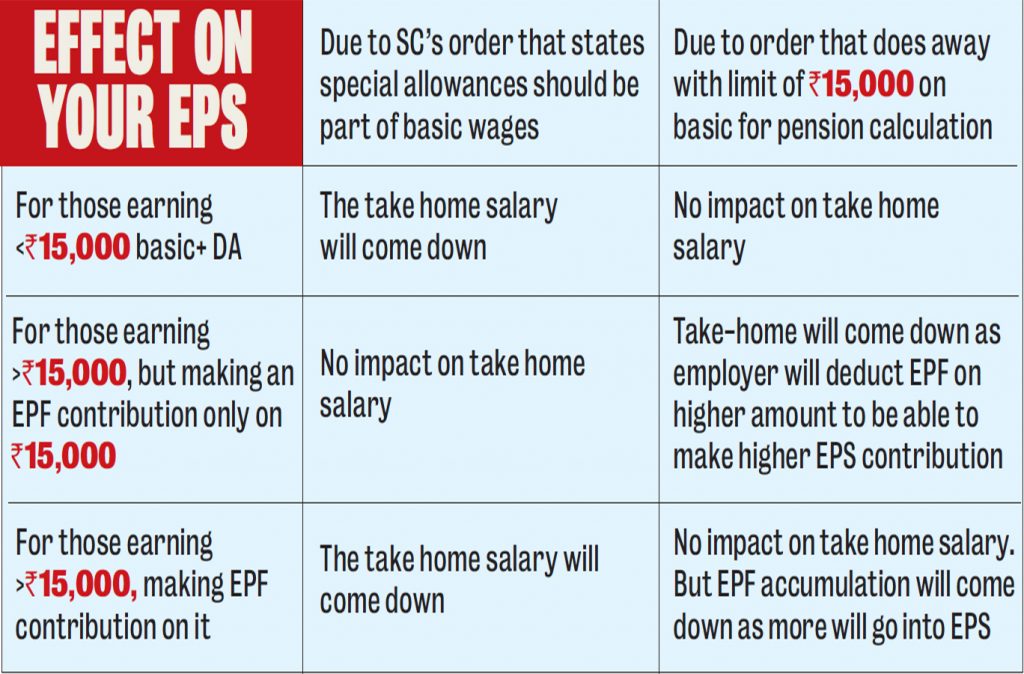

6 What about those who are currently working and have enough years left for retirement? Here there are several situations that need to be discussed. Let’s first consider those whose basic plus DA is less than Rs 15,000 per month. In this case, no change in take home salary will happen because of Supreme Court’s dismissal of the special leave petition of EPFO. But do remember that in February 2019, the Supreme Court had said that special allowances should be a part of basic wage, while deciding how much money should go towards EPF contribution.

Hence, taking both these things into account, net-net, the take home salary of individuals in this bracket might come down if their salary structure has special allowances.

7 Let’s now consider those earning a basic plus DA of more than Rs 15,000, but making an EPF contribution only up to Rs 15,000. In this case, there will be no impact on the take home salary because of the February decision. But the dismissal of the EPFO petition will lead to the allocation towards EPS going up and hence, the take-home will come down.

8 Let’s now consider those earning a basic plus DA of more than Rs 15,000 and paying an EPF contribution on the entire amount. In this case, the take home salary will go down because of the February SC decision which makes special allowances also a part of the basic wage, while calculating how much money should be contributed to EPF. Also, the dismissal of the EPFO petition will have more of an accounting impact. More money will allocated to the EPS than currently is. It will not have an impact on take home salary. Having said that with more money going towards the EPS, the EPF on maturity will come down.

9 What does this mean for those who have a salary of more than Rs 15,000 per month and have an option of opting out of EPF, at the time of joining. Does it make sense for them to opt out and instead become a part of the National Pension Scheme (NPS)? NPS was thrown open to the general public in May 2009.

The corpus accumulated under the EPF is tax free on maturity. The same is not true for NPS. Only up to 40% of the retirement corpus accumulated under NPS is tax free. Of the remaining 40%has to be used to buy an immediate annuity to generate a regular income.

For the balance 20% you have the option to either buy an annuity or withdraw it and pay tax on it. Having said that, this might change in the near future. If anyone wants to withdraw 100% of their corpus under NPS, they will have to pay tax at the marginal rate on 60% of the corpus. Hence, to that extent EPF still make sense over NPS.

Also, in case of EPS, the employee will have a good idea about his pension, given that it is a certain proportion of his pensionable salary (or the 12 month average of his basic plus DA).

In case of NPS, it will depend on how much the immediate annuities offered by insurance companies are paying out.